What happened to an aircraft carrier's Chinese panel market in a month?

More than ten years ago, Panasonic tried to subvert the entire display industry with new plasma technologies. However, due to technical closures and strategic failures, Samsung Display and LG Display's LCD technology came to dominate. Afterwards, the larger the voice power of the Korean brothers in the market, the sharper investment by Sharp and Sony in the LCD panel at the time led to a situation in which Japanese and Korean companies were on the upstream control panel.

While China's LCD industry has risen, the CRT industry that it took 20 years to accumulate has collapsed quickly. Due to the slow transition, LCD panels have long been dependent on imports.

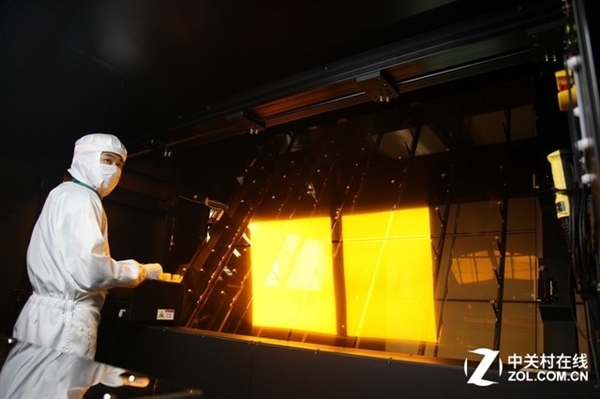

Fortunately, five or six years ago, under the strong support of the government, BOE, China Star Optoelectronics and other active layout of liquid crystal display technology, China's flat panel display industry has played an important significance to enhance the overall strength. In the meantime, because bad news such as persistent losses and low technical margins were frequent, they were controversial, but they always insisted on doing it. Although the start was relatively late and the technology was weak, the market passive situation caused by the technological gap was gradually improved.

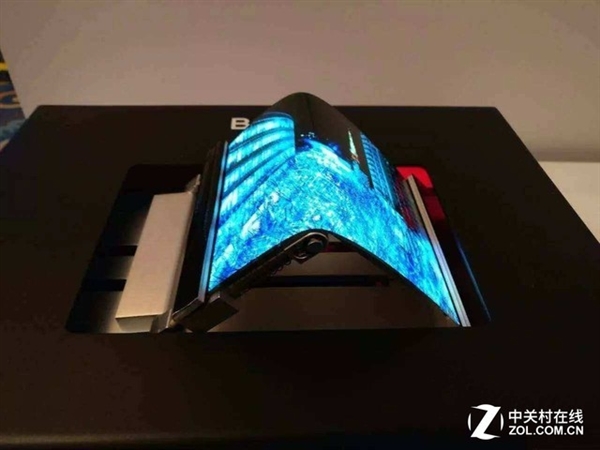

Since 2016, display technology has ushered in a new round of innovation. OLEDs, quantum dots, lasers, etc. have begun to emerge, and they are now firmly occupying the high-end display market. If China's panel companies are planning to display LCD technology at the same time as Japan and South Korea at least 10 years in the evening, then the layout of the "OLED" technology, which is most likely to replace LCDs, will be much faster. Unlike the earlier LCD panels that were not optimistic about their investment and their responses from their peers were not positive, this time Chinese companies are more proactive and positive in their treatment of OLEDs.

In the past year, the total investment of 12 panel projects that were commissioned, started, and newly signed in mainland China reached 335.8 billion yuan, and an average of 28 billion yuan per month was invested. We must know that the cost of China's "Liaoning Ship" aircraft carrier is about For 26 billion yuan, China's investment in the panel market in 2016 took out a Liaoning ship quite a month.

In the next three years, it is expected that China's investment in small and medium sized OLED panels and ultra-high generation lines will continue to grow at a high rate, and the new investment will exceed RMB 500 billion. However, China does not hesitate to invest heavily in the panel market. What changes can be brought about and what problems will it encounter? We then look down.

China successfully squeezed Japan into the world's top three

Japan was the world's largest manufacturer of panels in the 1990s, but by the late 1990s, Samsung had surpassed Japanese panel makers to become the world's largest panel maker. Since 2000, South Korean companies Samsung and LG have become the top two global panel suppliers. Since then, Japanese panel production has begun to lag behind.

As time goes on, China's Taiwanese panel makers will take the lead. The rise of five tigers, such as Chi Mei, AUO, and Guanghui, has promoted China's Taiwan to be the second largest producer of panels next to South Korea. Now after many integrations, Taiwan has formed two major panel companies, Innolux and AUO. At the same time, at the beginning of last year, Taiwan’s Foxconn formally acquired Japan’s panel maker Sharp, enhancing its ability to produce panel core patents and completing an important strategic transformation.

Continental panel factory is naturally not far behind, in the OLED technology has become a general trend, BOE, China Star Optoelectronics has invested heavily in OLED panels in the past two years, in addition to the production of small and medium OLED panels such as Hehui Optoelectronics, Rouyu Technology, etc. The company continues to expand its production. Among them, Rouyu Technology has also obtained Huawei, OPPO, and vivo investments from the top three in the Chinese mainland and the top five mobile phone brands in the world. It is expected that next year, China's OLED panel production scale will be greatly expanded, as the LCD panel has become the world's three major production areas of OLED panel.

On the other hand, Japanese panel companies have only JDI (Japan Display Inc) left after the acquisition of Sharp. JDI is focusing on small- and medium-sized LCD panels. The company wanted to increase the expansion of OLED panels by increasing its holding of JOLED. However, JDI itself has been losing money for three consecutive years. The holding plan has also been postponed from the end of this year to next year. Japan's decline in the panel market seems inevitable, while mainland China, Taiwan and South Korea are the protagonists of future panel competition.

Heavy investment in the panel market is a double-edged sword

2016 is undoubtedly the hottest year for Chinese display panel investment. The concept of “display everywhere†proposed by the Internet of Things has opened up a huge space for the panel industry. The rapid growth of investment in the Chinese display panel industry is partly due to the vastness of the Chinese market and investors are extremely optimistic about the panel industry. On the other hand, it comes from local governments' strong support for the panel industry. It also gives a lot of preferential policies in land and taxation, and even some local governments directly invest in the industry.

In the next five years, the world is expected to add 18 new panel production lines, of which China will occupy 14. Driven by the market and policy factors, foreign panel makers will actively build plants in China, which will further accelerate the global panel production to accumulate in mainland China. In terms of display technology, LCD will continue to dominate and OLED will become the main growth point. China is expected to surpass South Korea in 2019 and become the number one panel producer.

But everything has two sides. At present, the investment in the panel industry is hot, but the signs of unordered investment have also been initially revealed. In some places blindly building lines, a large number of non-leading enterprises influx, and the over-indulgence of industrial layout is not conducive to the healthy development of the industry, but also makes the panel industry is facing hidden risks of structural overcapacity. At the same time, the display technology is growing so fast that rapid iterations bring new variables to the direction of the industry.

At present, some companies do not consider the conditions of technology, capital, talents, etc., and blindly build the line. At the same time, in order to realize the display industry, many companies purchased old lines without conditions, transplanted overseas outdated production capacity to the country, and increased the risk of investment. This disorderly investment may lead to a structural surplus or even a full surplus in the industry. On the other hand, it will cause market chaos and trigger vicious competition such as price wars. If the entire industry pursues low costs, it will definitely affect the normal profitability and R&D investment of the company, which in turn will cause the industry to stagnate.

While China's mainland panel makers are actively investing in factories and factories, they should be wary of the problem of structural overcapacity. At the same time, in the technical field, it is necessary to pay close attention to what kind of speed OLED will replace the liquid crystal. Previously due to the appearance of liquid crystal, it directly led to the sudden termination of the CRT display industry. Therefore, we need to pay close attention to the forward-looking technological development in the display field. If the display technology turns sharply in the future, we need to be alert to subversive technologies that will cause this industry The impact cannot be repeated in the mistakes of CET.

ZGAR TWISTER Disposable

ZGAR electronic cigarette uses high-tech R&D, food grade disposable pod device and high-quality raw material. All package designs are Original IP. Our designer team is from Hong Kong. We have very high requirements for product quality, flavors taste and packaging design. The E-liquid is imported, materials are food grade, and assembly plant is medical-grade dust-free workshops.

Our products include disposable e-cigarettes, rechargeable e-cigarettes, rechargreable disposable vape pen, and various of flavors of cigarette cartridges. From 600puffs to 5000puffs, ZGAR bar Disposable offer high-tech R&D, E-cigarette improves battery capacity, We offer various of flavors and support customization. And printing designs can be customized. We have our own professional team and competitive quotations for any OEM or ODM works.

We supply OEM rechargeable disposable vape pen,OEM disposable electronic cigarette,ODM disposable vape pen,ODM disposable electronic cigarette,OEM/ODM vape pen e-cigarette,OEM/ODM atomizer device.

Disposable E-cigarette, ODM disposable electronic cigarette, vape pen atomizer , Device E-cig, OEM disposable electronic cigarette

Shenzhen WeiKa Technology Co.,Ltd. , https://www.oemvape-pen.com